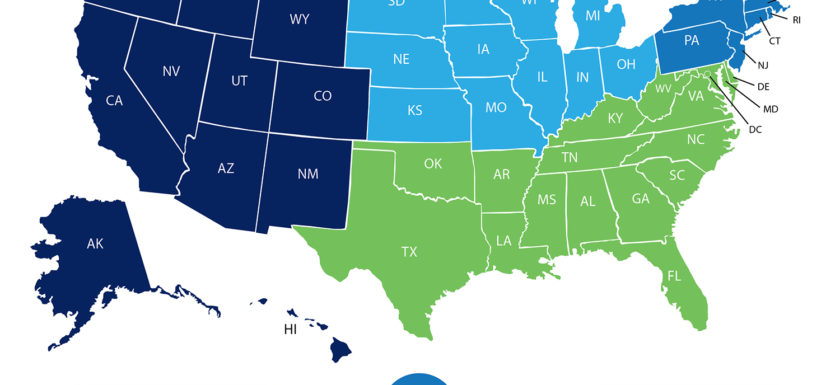

Over Half of All Buyers Are Surprised by Closing Costs

According to a recent survey conducted by ClosingCorp, over half of all homebuyers are surprised by the closing costs required to obtain their mortgage. After surveying 1,000 first-time and repeat homebuyers, the results revealed that 17% of homebuyers were surprised that closing costs were required at all, while another 35% were stunned by how much higher the fees were than expected. “Homebuyers reported being most surprised by mortgage insurance, followed by bank fees and points, taxes, title insurance and appraisal fees.” Bankrate.com recently gathered closing cost data from lenders in every state and Washington, D.C. to be able to share the average costs in eachRead More →